Fully amortized loan calculator

At first more of the monthly payment will go toward the interest. With an SBA 504 loan you can obtain up to f 55 million from your CDC lender.

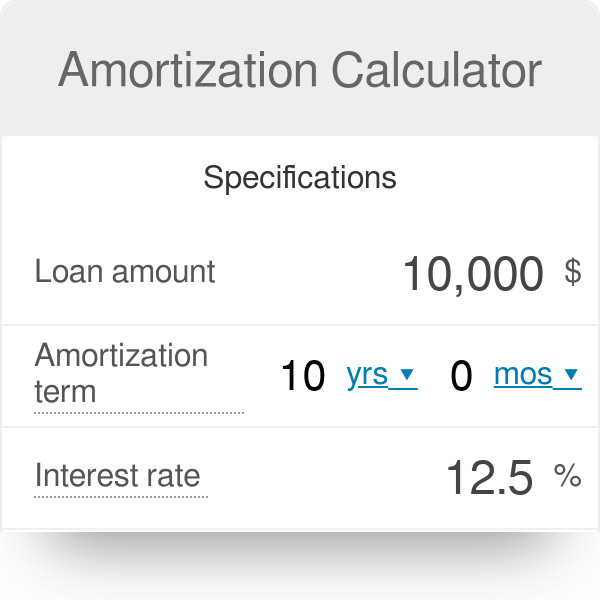

Amortization Calculator

You can use this type of loan to secure larger financing compared to an SBA 7a program.

. SBA 504 loans come with a fully amortized payment structure with a term of up to 20 years. Fixed Amount Paid Periodically. Your lender will recast your mortgage after the IO period ends and the monthly payment will be significantly higher to account for the fully-amortizing payment over a shorter 20-year term.

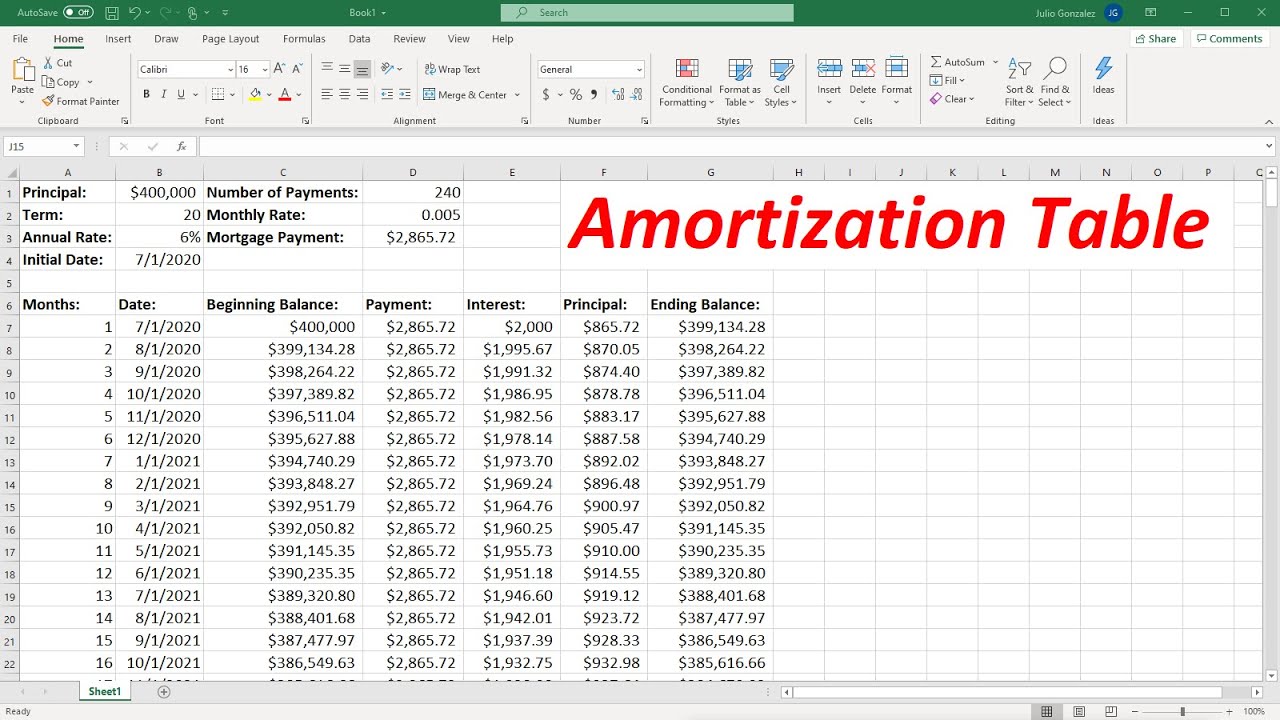

How to Calculate the Loan Payment. This spreadsheet creates an amortization table and graphs for an adjustable rate mortgage ARM loan with optional extra payments. The relationship between the interest rate and the balloon payment is non-linear.

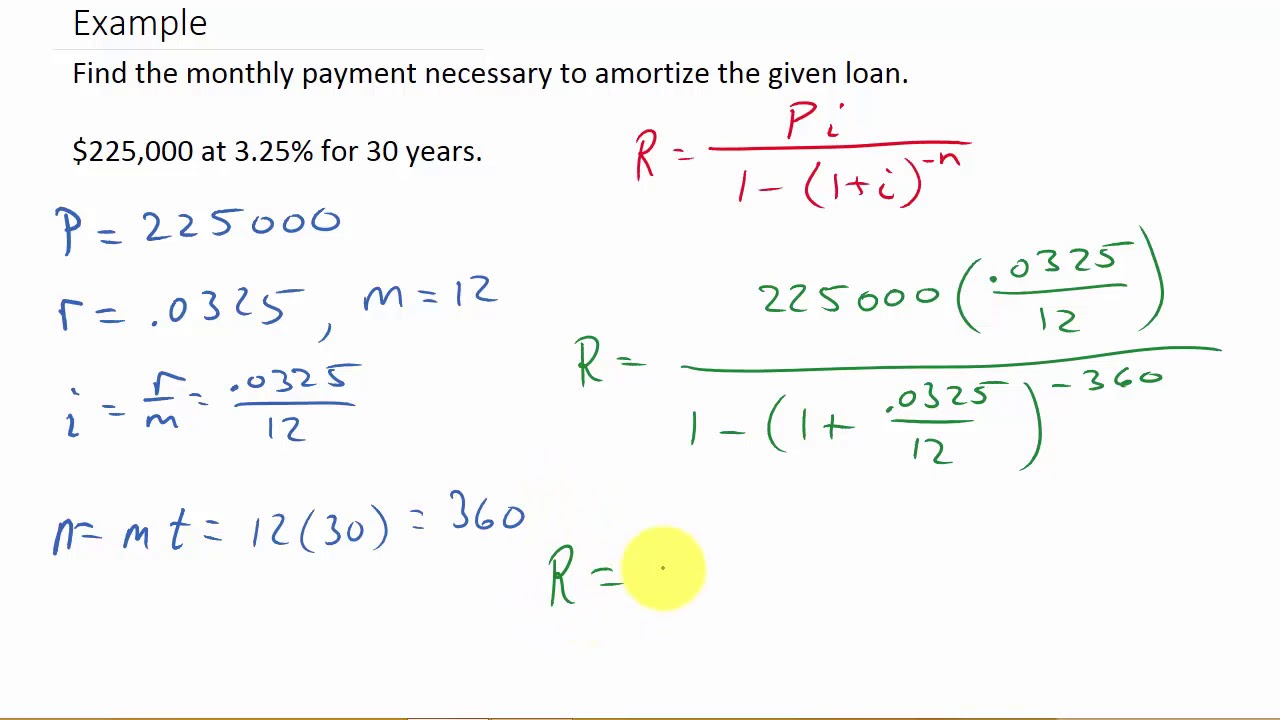

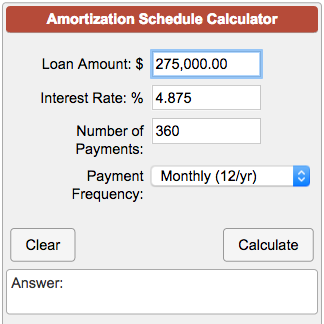

For fully amortized loans you typically need to calculate the payment amount A that will make the Future Value zero F0 after a specific number of years. The main download and the Google version now have. You can estimate your mortgage loan amortization using an amortization calculator.

Another example is a HELOC where you get a 10-year draw period and 15-year repayment period. Although the new mortgage loan was for Bills continued ownership of his main home it wasnt for the purchase or substantial improvement of that home. This is not a commitment to lend or any form of offer of credit.

The loan amount P or principal which is the home-purchase price plus any other charges minus the down payment. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. On the other hand you can secure up to 5 million from the bank lender.

As more principal is paid less interest is due on the remaining loan balance. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Qualifying for a mortgage loan involves debt ratio calculations that very slightly from one financial institution to the next.

Affordable housing refers to housing units that are affordable by that section of society whose income is below the median household income. All you do is allow the script to run temporarily and the calculator will work. The payment consists of both interest on the debt and the principal on the loan borrowed.

Bills first payment on the new loan was due July 1. Add-on Interest Add on Interest allows the user to set the periodic interest payment. 20 examples taken from Reg.

It means as interest rates on the loan increase the balloon payments can become very large. Though different countries have different definitions for affordable housing but it is largely the same ie. It is important because at higher interest.

It may be fully amortized or partially amortized as determined by the user. The spreadsheet includes an amortization and payment schedule suitable for car loans business loans and mortgage loans. With a balloon payment the payments are generally interest-only or low-interest for the first three five or ten years.

Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. The interest payment is the same regardless of the number of days in the month. An amortized loan payment pays the relevant interest expense for the.

Wikipedia defines a balloon loan or mortgage as a loan which does not fully amortize over the term of the note thus leaving a balance due at maturity. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Understanding a Loan Amortization Calculator.

She is a banking consultant loan signing agent and arbitrator with more than 15 years of experience in financial analysis underwriting loan documentation loan review banking compliance and credit risk management. Hence a fully amortized loan is a special case of a balloon loan where the balloon payment is equal to zero. At the end of a specific time frame or date a balloon payment is required to pay off the entire amount of the loan.

Affordable housing should address the housing needs of the lower or middle. Solve for multiple unknowns. He made six payments on the loan in 2021 and is a cash basis taxpayer.

A portion of each payment is for interest while the remaining amount is applied towards the. Amortization if your loan is fully amortized is a way to ensure that your loan will be paid off completely at the end of your loan payments. For instance the APR calculation for a 31 ARM assumes that after the first three years the loan increases to its fully-indexed rate or rises as high as its allowed to under the loans terms.

How it works is that the loan is amortized or spread out over a long period of time. The annual interest rate r on the loan but beware that this is not necessarily the APR because the mortgage is paid monthly not annually and that creates a slight difference between the APR and the interest rate. In these examples the lender holds the deed or title which is a representation of ownership until the secured loan is fully paid.

Add-on Interest loan types will have a remaining principal balance at the loans maturity. Add-on Interest Add on Interest allows the user to set the periodic interest payment. In most cases the borrowers debt ratio is analyzed using the fully amortized payment.

The interest payment is the same regardless of the number of days in the month. Get 247 customer support help when you place a homework help service order with us. Calculate and print a fully compliant Regulation Z APR disclosure statement.

Cierra Murry is an expert in banking credit cards investing loans mortgages and real estate. The formula for the payment amount is found by. Bill used the funds from the new mortgage to repay his existing mortgage.

It may be fully amortized or partially amortized as determined by the user. Add-on Interest loan types will have a remaining principal balance at the loans maturity. Assuming you choose a fixed-rate mortgage you.

Pros Of Fully Amortized Loans A fully amortized loan allows you to budget more easily because you know how your monthly loan payment is divided up. The final payment is called a balloon payment because of its large size. Calculate the monthly payments total interest and the amount of the balloon payment for a simple loan using this Excel spreadsheet template.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. This auto loan calculator is not limited to solving car loan problems of course. An amortized loan is a loan with scheduled periodic payments that consist of both principal and interest.

A new Tabulated worksheet has been added that allows you to use a table to list interest rate changes by date. It can be a useful tool whenever money is borrowed to purchase an item requiring a down payment. The number of years t you have to.

Calculator is for estimation purposes only based on the information provided by user. Estimate the maximum interest rate and monthly payment for common fully amortized ARMs. Have a 24 month balloon starting on 6302022 amortized over 30.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Time Value Of Money Board Of Equalization

How To Calculate Amortization Payments Youtube

How To Create An Amortization Table In Excel Youtube

Amortization Schedule Calculator

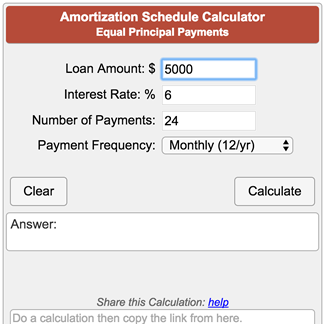

Amortization Schedule Calculator Equal Principal Payments

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

/ScreenShot2019-01-15at3.35.40PM-5c3e455dc9e77c0001915edd.png)

Amortization Calculator

Loan Amortization Schedule Calculator Spreadsheet Templates

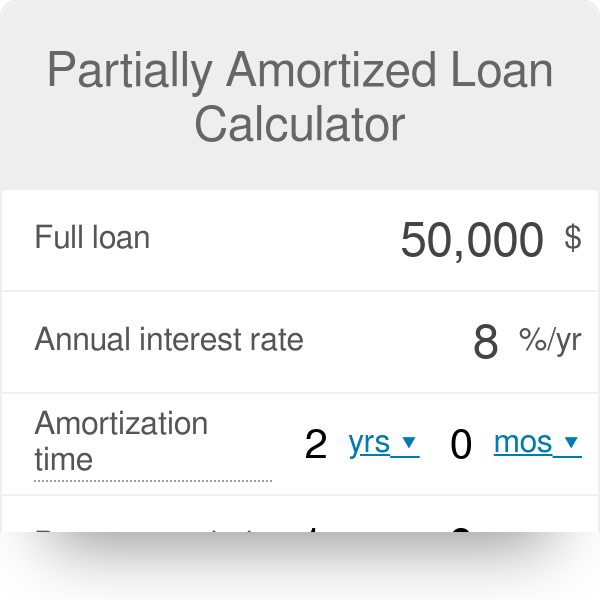

Partially Amortized Loan Calculator Balloon Payment

Simple Interest Loan Calculator How It Works

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is Amortization Schedule

Loan Amortization Calculator

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed